Service Parts Management

Service Parts operations throughout all industries pose one of the toughest supply chain management challenges. Yet Service Parts operations are a major component of the economy, with the potential to be highly profitable:

Spare parts represent $700 billion in spending and 8% of GDP in the United States alone. Piper Jaffray, U.S. Bancorp

Total spending on Service Parts related activities increased at a CAGR of 9%+ during the past 4 years. UPS Logistics

Customers will spend five to twenty times the initial sales price on subsequent services and consumables. AMR Research

INDUSTRY OUTLOOK

To succeed in today’s competitive marketplace, companies recognize that after-sales service can help differentiate them from competitors while providing additional highly profitable revenue. Our experience indicates that while after-sales service divisions make up only a small portion of a company’s revenues, they have the potential to contribute to a majority of the profits.

Improving performance can have big benefits. Aftermarket parts and services have a profit margin as much as 10 times that of initial product sales and account for 20% to 30% of revenues and 40% of profits for most manufacturers. Also, good service breeds customer loyalty. Spare parts and services account for 8% of the U.S. annual gross domestic product. More than $700 billion is spent on spare parts and services, according to Aberdeen, and Meta Group puts the global figure at more than $1.5 trillion.

The aftermarket has only recently gone from being viewed as a cost center to a source of revenue, and many companies have a lot of catching up to do in terms of operational efficiencies. Forrester Research estimates that manufacturers’ service supply networks are 10 years behind their product supply networks in terms of process sophistication and use of packaged applications and that during the next five years these companies could spend up to $3.7 billion on improvements.

The cost of poor service parts management can be high, but it’s often hidden in the high margins service offers. According to the Aberdeen Group, companies responding to a service delivery survey reported an on-time delivery performance of 89% and first-time fill rates of 82%, which means more than 1 in 10 service parts deliveries are late.

Service parts supply chains are complex. They can feature multiple distributions and service delivery channels. Traditional thinking indicates additional investments in service parts inventory and working capital are required to meet ever-changing customer expectations. But world-class companies may be able to satisfy customer demands by viewing the complete supply chain as an untapped source for generating value. Instead of thinking of the supply chain, think of it as an adaptive value chain.

Moving from the supply chain viewpoint to the adaptive value chain viewpoint is a mission-critical competency that a company’s service parts organization must master. Mature companies striving to satisfy increasing customer expectations and gain a competitive advantage in challenging markets must reinvent the way they balance supply with demand to achieve higher levels of operating efficiency. Businesses in both growing and established markets must address the fact that their service delivery and service parts supply chain capabilities may no longer adequately keep pace with increasing competition and customer service expectations.

SGC PARTNERS PERSPECTIVE ON SERVICE PARTS MANAGEMENT ISSUES

Historically, there has been low corporate investment in Service Parts operations, as Service Parts Organizations took a back seat to Original Equipment (OE) production. Adding to the difficulty is the fact that organizations are operating with legacy systems that are often 20 years old or more and point solutions are not integrated. Software companies have not sufficiently addressed this market in the past.

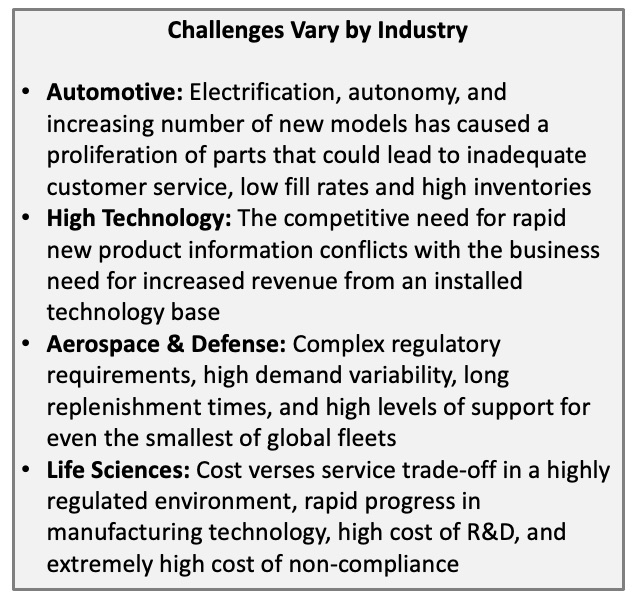

From our work in the Service parts industry, the most typical challenges companies are facing in the current market environment are characterized by:

- High numbers of SKUs with complex interchangeability make it difficult to effectively forecast, set stock or rotatable levels, plan and process orders with existing planning staff, and utilize customer-owned inventories.

- Low inventory turns with the accompanying need to manage high service level and contract-driven requirements represent significant challenges. In addition, the industry is experiencing sporadic, low volume demand, part number proliferation, complex interchangeability, long lead times, and variable supplier and vendor performance.

- Material Flow Volatility represents the need for solutions that connect the buying organization to the supply organization and every function in between.

- Higher customer service level expectations are a result of customers maturing in their practice of procuring services. As they have different service experiences, they expect more, better, faster and cheaper. And as more competitors enter the services arena, customers have more choices. Thus, service providers must excel in operational performance and creative contract structure to shape the customer experience and increase loyalty.

- Lack of supply chain visibility represents the need for better event management and cooperation between companies to improve response time, increase velocity, track serial numbers, smooth demand, reduce inventory redundancy, and increase efficiency.

- Poor warehouse productivity and/or inventory accuracy cause customer service problems and eroding profitability.

- High obsolescence and excess inventory are caused by inaccurate initial provisioning, ECOs without consideration for service inventory, premature or unnecessary part repair, returns, product life cycle transitions, management decisions to maintain additional platforms, and end of life buys.

- Network complexity represents the need to rationalize and/or reconfigure the distribution network to provide better customer service.

- Higher transportation costs are caused by increasing customer delivery expectations, more small shipments, and wider geographic coverage.

In SGC’s point of view, there are dramatic potential benefits available to service parts organizations for investing in operational improvements. While there are challenges faced in this market, they are far outweighed by the potential benefits which include:

- Inventory reductions of 30-50%

- Fill-rate lifts from the low 90s to the high 90s

- Revenue increases of 5-7%

- Warehouse productivity gains between 20-30 %

- Transportation cost reductions of 8-15 %

- Return on investment as high as 60%

- Additional benefits reaching 5-10 times the up-front investment

SGC PARTNERS SOLUTIONS FOR SERVICE PARTS ORGANIZATIONS

SGC Service Parts Management practice provides a portfolio of solutions to help manufacturers improve the sales growth and profitability of their aftermarket service and parts operations.

Our comprehensive portfolio of services is grouped around three key areas:

- STRATEGY

- EXECUTION

- MANAGEMENT

STRATEGY

The SGC Partners service parts strategy serves as the Building blocks for enabling an end-to-end service delivery organization and/or are solutions that are applicable to both the Customer Relationship and Supply Chain operations. The service strategy will determine what services to sell, who to target, how to price, and whether to deliver the product yourself or through partners. This strategy will help in identifying and prioritizing new offerings based on their potential to create value. Another key point of the SGC service parts strategy is the ability to identify the best approaches to implementation, including solution creation and infrastructure requirements.

SGC delivers speed to value through a number of focused approaches. These approaches are the key to jump-starting strategic service parts development. These approaches include: 2 Day Drop-In, Rapid Assessment, Solution Prototype and Proof-Of-Concept.

- 2 Day Drop-In – This is a two-day accelerated effort in which we work with the client uncover opportunities and breakthrough ideas to improve service delivery and increase service revenue.

- Rapid Assessment – A business-case-driven multi-phased methodology and approach that builds organizational alignment around a portfolio of prioritized improvements. It can range from 4 – 12 weeks depending on the scope and can be an alternative to a 2-Day Drop-In.

Some of the outcomes include:

-

-

- Assess capabilities against leading practices

- Quantitatively assess current performance

- Synthesize process & technology gaps & design high-level solutions

- Prioritize the solutions into a future state vision and roadmap

-

- Solution Prototype and Proof-Of-Concept: The goal of this approach is to build a prototype with a limited scope to prove the solution and business case. There is usually a short decision- making period for the client to evaluate the solution in production. Depending on the enabling technology we typically see these engagements lasting 9-13 weeks. The value adds of this approach is the client has mitigated some investment risk yet gets to evaluate the solution in a live environment.

- What should be outsourced around people, processes, and technology

- Determining the best outsource provider

- Deal structuring

- Accuracy and completeness of the information

- Real-time information

- Reduced processing and administration costs

- Increased worker productivity and efficiencyRelationship management

EXECUTION

Supply Chain Focused Solutions

Forecasting & Planning: SGC’s solution enables your company to better understand its demand drivers in order to more accurately forecast your customer’s requirements by integrating disparate planning processes and address data challenges that inhibit a robust planning system. The solution is designed to help clients improve planning to achieve:

-

- The right stock at the right location

- A fully collaborative environment that includes internal entities, suppliers, repair vendors, and customers

- Improved responsiveness to customers

- Proactive management of assets

- Reduced inventory levels and material spend while improving customer service levels

Inventory Deployment: This solution enables a company to better understand the location of supply compared to the location of demand in order to accurately forecast inventory requirements. Inventory deployment becomes critical to ensuring high customer satisfaction while keeping material and distribution costs low. The solution is designed to help clients improve in the following areas:

-

- Systems Analysis – Make recommendations to the logic of material planning systems and put in place leading practices

- Increase service levels

- Reduce lead times

- Reduce back orders

Reverse Logistics & Fulfillment: SGC’s solution is enabled by technology that helps clients improve Repair Part Supply and Return performance. Proactive end-to-end visibility, event, and performance management system, during the service part fulfillment and return/ repair/ remanufacturing life cycle, enables you to:

-

- Eliminate (or reduce) the need for your own internal DCs.

- Focus instead on monitoring and policing

- Shift responsibility to Suppliers

- Reduce disposition time

- Eliminate the part backlog

- Track serial numbers, connecting the serial number of the replaced part with the new part serial number

- Manage campaigns driven by SBs or other programs

Procurement: SGC’s solution optimizes the total acquisition cost of materials and services as it relates to service delivery and customer support. A sound sourcing strategy enables you to:

-

- Optimize and leverage buying power across the total organization

- Manage content more effectively and utilize decision support tools for more accurate purchases

- Perform web-based transactions and have total supply chain visibility to procured material

Network Strategy: SGC’s solution reduces total logistics cost and cycle time while incorporating superior customer service. It addresses key issues involving the redundancies and trade-offs in the current network while having the flexibility to adjust for future demand and supply fluctuations. This solution provides the company’s will the following benefits:

-

- Creating differentiated service segments

- Improved sourcing and inventory staging across all locations

- Optimize the number, size, and operations of distribution centers required to meet service requirements and future growth

- Reduced transportation and expediting costs

- Optimize the number, size, and operations of distribution centers required to meet service requirements and future growth

Customer Relationship Management Solutions

Services Optimization: This solution optimizes and/or consolidates all aspects of the service delivery process through multi-channel integration including contact center operations, field service operations and self-service capabilities. Optimized services enable you to:

-

- Effectively deploy and manage service resources

- Optimize the cost of customer interaction

- Identify areas of consolidation based on capacity and cost review

Supply Chain Event Management & Business Intelligence: This solution provides end-to-end visibility and event management during service part life cycle to enable your network to become adaptive to changing business conditions. This solution provides the following benefits:

-

- Gain the ability to accurately measure supplier performance

- Event-based detection and resolution of supply chain breakdowns

- Reduced expediting costs and better customer service

MANAGEMENT

Entitlements and Claims Management: Warranty and Contracts: This solution defines optimal processes and technology solutions to manage warranty and contract entitlements with customers and component OEMs. The Focus is on warranty tracking and claims processing of returned material, to verify and track warranty reimbursement for material and labor from supplier OEM’s. Companies benefit from the following:

-

- Enables accurate entitlement verification and warranty claims processing and tracking, leading to reduced fraud and unneeded delivery costs

- Enables multi-echelon entitlement attachment capabilities and sales processes to optimize warranty up-sells and cross-sells as well as variable service contracts

Mobility Field Operations: SGC’s mobility solution extends the enterprise’s support systems and processes out to the field using the application of mobile devices and wireless technology to enable communication, information access and business transactions from any device, from anyone, from anywhere, at any time. The following field service challenges are addressed in this solution:

-

- Accuracy and completeness of the information

- Real-time information

- Reduced processing and administration costs

- Increased worker productivity and efficiency

Outsourcing: This solution offer evaluates a company’s core competencies around its service business and determines what portions are candidates for outsourcing. This is a holistic solution that not only identifies opportunities but also helps the client with sourcing and implementation including:

-

- What should be outsourced around people, processes, and technology

- Determining the best outsource provider

- Deal structuring

- Relationship management

THE POWER OF COLLABORATION

Although a much-used word, collaboration creates a multiplied return. The same is true when implementing more than one of the solutions in the Service and Parts Management portfolio. For example, the benefit of implementing a “Forecasting and Inventory Deployment” solution will have marked improvements to both the income statement and balance sheet. The implementation of the “Forecasting and Inventory Deployment” solution along with a “Supply Chain Event Management and Business Intelligence” solution has more than an added effect; the benefit multiplied. These solutions combine to improve asset management. Information from collected business intelligence provides the intelligence to create an improved forecast. Each 2% improvement in the forecast yields a 1% decrease in inventory. In addition to reduced inventory, fixed assets are reduced with the reduction in required warehouse space. These solutions combine to reduce operating expenses and increase gross profit. Premium freight is reduced through proactive event management and increased forecast accuracy; lead times are reduced. These two solutions also combine to reduce scrap and obsolescence by increased forecast intelligence.

SGC PARTNERS

SGC would value the opportunity to talk with you regarding our ability to help you achieve your objectives. We can quickly assemble an experienced team of professionals to help you achieve your goals with our relevant expertise, powerful methodologies, and best-in-class alliance partners.

FOR MORE INFORMATION ON SERVICE PARTS MANAGEMENT, CONTACT US HERE FOR A COMPLIMENTARY CONSULTATION.