Successful M&A Integration: The time to start is NOW!

Mergers and acquisitions which are well-conceived and properly executed can deliver greater value. As deal activity accelerates, some companies are improving. Although 10+ years ago about 50 percent of mergers in the US underperformed their industry index, recently, only about 30 percent were underperforming. One explanation is that some companies have learned to pursue deals closer to their core business, which increases the odds of success. More-frequent acquisitions have also motivated companies to develop repeatable models for successful integration. Despite these successes, many acquirers leave value on the table.

Companies continue to stumble in three broad areas of post-merger integration:

- MISSED TARGETS: Companies fail to clearly define the deal’s primary sources of value and its key risks. They don’t set clear priorities for integration, and the target company’s people don’t integrate themselves. Others do have an integration program office, but they don’t get it up and running until the deal closes. Still, others mismanage the transition to line management when the integration is supposedly complete, or fail to embed the synergy targets in the business unit’s budget. All these difficulties are likely to lead to missed targets or an inability to determine whether the objective are achieved.

- LOSS OF ESSENTIAL PEOPLE: Many companies wait too long to put new organizational structures and leadership in place; in the meantime, talented executives leave for “other opportunities.” Companies also may fail to address cultural matters – the “soft” issues that often determine how people feel about a changing culture; talented people drift.

- POOR PERFORMANCE IN THE BASE BUSINESS: In some cases, integration soaks up too much energy and attention or simply drags on too long, distracting managers from the core business. In others, uncoordinated actions or poorly managed integrations lead to active interference with the base business and may result in, for example, contradictory communications with customers. Competitors will take advantage of the confusion.

SUCCESSFUL INTEGRATION: Successful integration is the key to avoiding the risks of a merger or acquisition and to realizing its potential value. And it is complicated by the simple fact that no two deals should be integrated in the same way, with the same priorities, or under the same timetable.

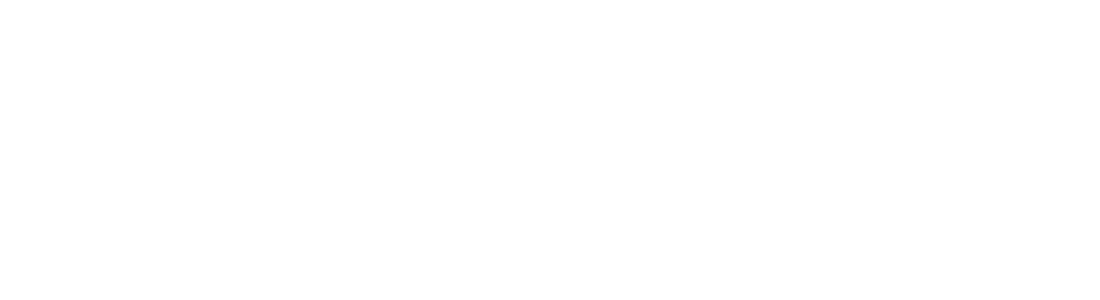

TEN ESSENTIAL GUIDLINES can make integration more manageable and lead to the desired outcome:

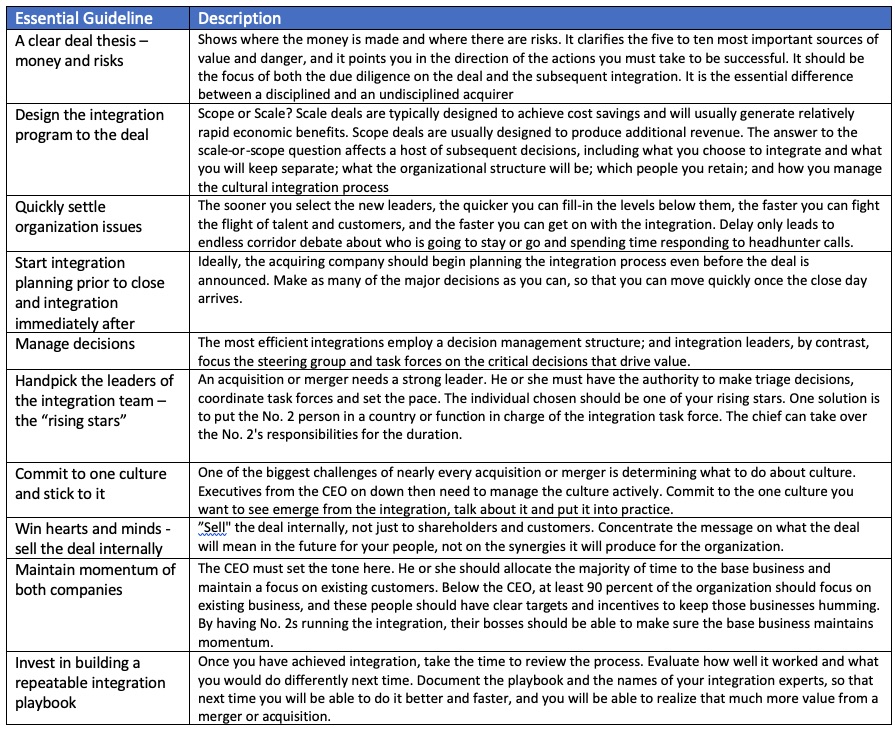

SCOPE VS. SCALE DEALS

A different approach is required for Scope OR Scale deals. And, although we separate the two, in fact there are deals that are a hybrid, including some aspects of Scope AND Scale. The following table shows Scope OR Scale. You will need to understand the Hybrid deal in detail to determine what middle ground or compromise to follow.

RECOMMENDED ACTIONS:

The following Seven Steps are recommended as your integration mandate:

- Provide a strategy continuity from due diligence through post-acquisition integration, operation, and divestiture

- Focus senior management and integration taskforces quickly on the critical decisions

- Clearly, articulate the financial and non-financial results you expect, and by when

- Carefully coordinate the timing of decisions, and everyone needs to understand the impact their actions have on others

- Map out who is responsible for each decision and communicate that to all involved

- Focus on decisions, not on process for process’s sake

- Align leadership and change errant behaviors

Regardless of where you are in the process the time to start integration is now!

For more information on Successful M&A Integration, contact us here for a complimentary consultation.