Medical Technology: MRO Excellence

Spare parts represent $700 billion in spending and 8% of GDP in the United States alone. —Piper Jaffray, US Banco

Total spending on service-related activities increased at a CAGR of 9%+ during the past 4 years. — UPS Logistics

Service operations constitute a significant component of the global economy, with the potential to be highly profitable. Yet, service operations throughout all industries pose one of the most robust management challenges.

SGC Partners (SGC) projects that global Medical Technology service revenues will likely exceed $25 billion in 2023. The challenge for service executives is to produce profitable results in line with corporate and shareholder expectations. Achieving this will require:

- Relentless focus on understanding emerging customer requirements and designing new services consistent with industry trends.

- Careful selection of investments that will lead to improved productivity and customer satisfaction and have a clear ROI.

- Skillful integration of business functions/departments across the organization; and, for many, effectively integrating the operations of acquired companies.

- Strategies to maximize the effectiveness of the supply chain and, in particular, the assets utilized to provide service.

SGC’s Perspective on Medical Technology Service Management

Original Equipment Manufacturers (OEMs) in the Medical Technology industry need robust solutions to deal with several current trends. SGC has identified four trends that will continue to affect the industry for the foreseeable future:

- Tight Healthcare Marketplace: There will be continued cost pressures on the key customers served (e.g., hospitals, clinics, labs), and will provide opportunities for new services and will demand lower-cost solutions to complex situations.

- Increased Complexity: Navigation through technology advancement, automation, integration, and multivendor service requirements will prove more challenging. With the bundling of services and products added complexity exists.

- Connectivity: New technologies are affording opportunities to link directly with customer’s equipment and to enable field service personnel to work more effectively (e.g., field service mobility solutions).

- Intense Competition: Many companies will experience the fierce competition brought about due to the consolidation in the industry. They must also compete with emerging third-party providers and the capabilities of the customers themselves.

As a result, Medical Technology OEMs are focusing on product and service innovation (via attractive features, competitive pricing, and feature enhancements) and enhanced customer service (through higher speed, customization of offers, outstanding performance, innovative approaches) and more efficient order processing and billing. OEMs are beefing up their total supply chain efficiency by employing forecasting and network optimization solutions, as well as dynamic inventory deployment and lean distribution. They’re also looking at supplier management solutions to produce shorter lead times, increased flexibility, and collaboration. Remote diagnostics offer the possibility to make field service employees more productive by reducing the number of trips and ensuring that the right spares are available when they arrive onsite.

The Challenges and the Pay-Off

The Medical Technology industry needs new solutions to address its new complexity. Organizations are managing complicated supply chains with multiple, competing for distribution channels, an extensive product portfolio with a high number of SKUs, multiple material flow paths, and significant reverse logistics issues related to returns and the remanufacturing of components.

Historically, there has been low corporate investment in service operations, as Service Logistics have taken a back seat to Original Equipment (OE) production. Adding to the difficulty is the fact that organizations are operating with legacy systems that are often 20 years old or more, and software companies have not sufficiently addressed this market in the past. Low investment is evident by a chronic lack of visibility into supply chain operations and costs, as well as historically poor integration of service support software into mainline corporate information systems (e.g., ERP).

From our work with service companies, SGC has identified several key, common “pain points”:

- Loss of market share: As channel competition increases and customers are presented with new service options, some OEMs are seeing customers switch to other alternatives;

- Squeezed service margins: Falling new product prices in some segments is changing the replacement versus repair trade-off. The result is tougher competition and increased customer buying power;

- Low inventory turns: OEMs often experience low turns as they seek to meet the challenges of high service level requirements, sporadic, low volume demand, part number proliferation, long lead times, and poor supplier performance;

- Higher transportation costs: Excessive freight caused by increasing customer delivery expectations, more small shipments, wider geographic coverage and lack of tools to manage complex transportation options;

- Poor warehouse productivity and inventory accuracy, causing customer service problems and eroding profitability;

- High obsolescence and scrap, caused by inaccurate initial provisioning, part transitions, returns, product life cycle transitions, and end-of-life buys;

- Increasing customer expectations: As customers mature in their practice of purchasing services, and as they have different service experiences, they are expecting “more, better, faster, and cheaper.” Service providers must excel across several “moments of truth” that shape the customer experience.

Also, service management capabilities must adapt quickly and efficiently to changing market needs in terms of their structure (e.g., through plug & play technologies, outsourcing), operations (consistent processes), and better management practices.

To fully capitalize on the value opportunity, organizations will also need to integrate cleanly across three critical areas: Customer Lifecycle Management, Product Lifecycle Management, and Service Lifecycle Management. This integration will involve new ways of coordinating actions across multiple departments and will require superior ability to manage the complex business trade-offs involved.

In SGC’s point of view, there are dramatic potential benefits available to service organizations for investing in improved operations. While there are certainly challenges associated with implementing solutions, they are far outweighed by the potential benefits:

- Inventory reductions of 30 – 50%

- Fill-rate lifts from the low 90s to the high 90s

- Revenue increases of 5 – 7 %

- Warehouse productivity gains between 20 – 30 %

- Transportation cost reductions of 8 to 15 %

- Return on investment as high as 60%

- Additional benefits reaching five to 10 times the up-front investment

Strategic Change

Given the dynamic changes in the marketplace, the plethora of potential solutions, and the need for fast results, service executives must plan and execute strategies to transform their organizations. For many, it is a daunting task that becomes relegated to the time left after dealing with day-to-day operations. In light of the high expectations of shareholders and corporate leadership, this is not a sustainable position. A clear and defensible plan of action is required to address five critical areas and achieve success in the Medical Technology marketplace:

For some organizations, the pressure is further aggravated by the need to address merger challenges simultaneously. These often include inconsistent processes and procedures, and multiple computer systems, plants and service centers, call centers, product lines, and inventory locations. Swift action is generally the recommended approach. Specifically, the information regarding the complication of M&A may be found at http://sgc-partners.com/acquisition-integration/.

In general, to develop a coherent transition plan, take these several considerations into account:

- Current Business Environment: supplier lead times, distribution network, customer requirements, regulatory requirements;

- Pain Points: What must be done to satisfy customers or meet business needs? Includes customer demands, competitive actions and cash flow problems, information available on customers;

- Performance Gaps: KPI comparison to industry and leading practice benchmarks;

- Evolutionary Status: Current capabilities, recent initiatives, and strategic direction;

- Value Delivered: ROI (internal), market share growth (external);

- Budget & Resource Constraints.

SGC’s Solutions For Medical Technology

SGC provides a portfolio of solutions to help manufacturers improve the sales growth and profitability of their aftermarket service and parts operations. Our comprehensive portfolio of services includes Value Accelerators and Focused Solutions.

Value Accelerator: Strategic Roadmap

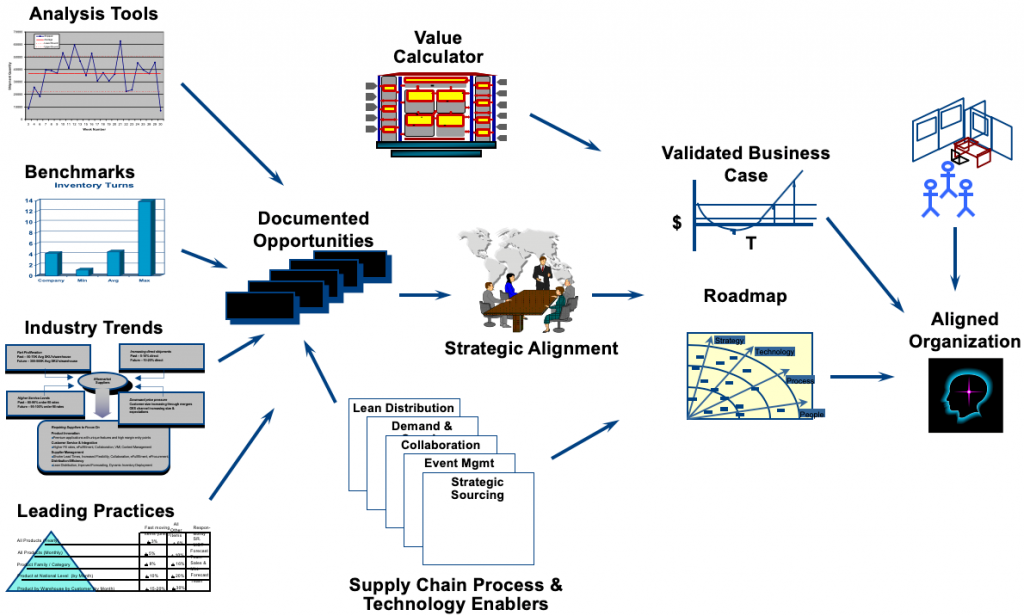

Building an adaptive supply chain requires a holistic, strategy-led approach to change. Moreover, the Medical Technology MRO supply chain requires a thorough understanding of the complexity Medical Technology companies deal with. SGC’s MRO Strategic Roadmap provides the analysis and design methodology to help clients move from confusion to action. Based on our experience in this segment, we find that most industry players have begun this process, but it remains either incomplete or suffers from some significant gaps.

In creating an MRO Strategic Roadmap, SGC performs a rapid analysis of how your company’s processes compared with leading practices employed by other Medical Technology companies and by the MRO industry in general. Working in conjunction with your personnel, SGC completes an extensive analysis and design process. During this phase, we work with you to evaluate and prioritize a portfolio of initiatives to build the MRO Strategic Roadmap, including a high-level implementation plan and a quantifiable business case that will guide your company through the transformation process.

This phase includes the use of a range of tools that include people, process, metrics, and technology enablers to tackle the complexity of building an integrated plan to align your organization for action.

Our recommendations are grounded in your company’s greatest improvement needs and potential market opportunities.

The solution results in:

- A portfolio of suggested strategic and tactical improvement initiatives

- Quantifiable value propositions supporting the business case

- An integrated, high-level implementation plan including risk and change management measures

Strategic Roadmap Process

Focused Solutions:

Forecasting & Inventory Deployment: In general, with every 2% of forecast accuracy achieved, there is a corresponding 1% decrease in inventory.

As a starting point, we would ask: How good is your current forecasting process, what level of error does it generated, and what are the associated penalty costs that your organization incurs?

SGC’s solution enables your company to better understand its demand drivers to forecast your customer’s requirements more accurately by integrating disparate planning processes and addressing data challenges that inhibit a robust planning system. The solution is designed to help clients improve planning to achieve:

- The right stock at the right location

- A fully collaborative environment that includes internal entities, suppliers, repair vendors, and customers

- Improved responsiveness to customers

- Proactive management of assets.

The SGC solution uses a holistic approach, including people, process, metrics, and technology. We align organizations to fit the new collaborative environment best, make process changes adaptive to the everchanging business climate, and define metrics for informed decision making that do not compete. And, implement technologies that continue to make substantial strides with a significant focus on reducing the elements that drive variability: Mean Time Between Failure (MTBF), Operations Data, Planned and Unplanned Maintenance, Asset Configurations, Marketing Intelligence, Configuration Management and resulting part interchangeability.

Reverse Logistics & Fulfillment: SGC’s technology solutions enable clients to improve repair part supply and return performance, so you gain the ability to manage the end-to-end supply chain proactively during the service part fulfillment and return/ repair/ remanufacturing life cycle. This solution allows you to:

- Eliminate (or reduce) the need for your own internal DCs

- Focus instead on monitoring and policing

- Shift responsibility to suppliers

- Reduce disposition time

- Eliminate the part backlog

- Track serial numbers, connecting the serial number of the replaced part with the new part serial number

- Manage campaigns driven by SBs or other programs

Supplier Management & Connectivity: SGC’s other technology and process solutions enable connectivity to suppliers, logistics providers, customers, and internal legacy systems. This allows all parties to share supply chain event transactions and perform proactive event-based detection and resolution of critical operational issues through web-based connectivity and closed-loop control. The solution provides:

- Visibility:Distributed, web-based access to significant value-chain events, statuses, levels, and capacities

- Performance Reporting:Leverages a centralized data repository to provide enhanced supply chain, vendor and internal performance measurements of the entire supply chain performance This reduces “multiple versions of the truth,” reliance on supplier and vendor performance data and reduces disagreement

- Issue Management:Provides collaborative communications and progress monitoring for companies, suppliers, and repair vendors to effect cause and corrective action for delivery or quality

- Contract Enhancements:To enforce policies written into contracts and often not exercised

- Web User Interface:To facilitate electronic message compliance with suppliers, repair vendors, and carriers

- Event Management & Alerting:Allowing for exception-based management of orders, shipments, levels, or events that will most impact supply chain performance

Field Service Automation/Mobility: Remote connectivity has the potential to impact service effectiveness dramatically. For example, this technology is deployed in the area of line maintenance, where tasks may be dispatched along with the tech publication and parts needed. Also, service manuals are on tablets, and 2-way IP cameras allow more seasoned technicians to assist less qualified technicians on repairs. Depending on your current solution, there may be opportunities to implement “quick hit” improvements in high return areas. Typically, we expect projects of this kind to provide demonstrable ROI within 3-6 months.

Next Steps:

SGC Partners has a proven track record in capturing value in a complex, distributed, and rapidly changing MRO environment. We would value the opportunity to talk with you regarding our ability to help you achieve your objectives. We have in-depth Medical Technology MRO industry knowledge gained from years of experience and many successful projects. We have an experienced team of professionals with Medical Technology MRO expertise to help you achieve your goals using robust methodologies and best-in-class alliance partners.

FOR MORE INFORMATION ON OPERATIONAL EXCELLENCE IN MEDICAL TECHNOLOGY MRO, CONTACT US HERE FOR A COMPLIMENTARY CONSULTATION.