Improving Profitability in Aircraft MRO Operations

MRO operations throughout all industries pose one of the toughest supply chain management challenges. MRO operations are a major component of the economy, with the potential to be highly profitable:

The aftermarket, driven by strong global airline demand, is pushing year-over-year growth in the high single digits, but pressure from several sources–notably struggling supply chains requiring extra resources and a lack of used parts due to low retirement rates–is presenting headwinds. – Canaccord Genuity

The commercial aircraft aftermarket parts market size is expected to Exhibit $51.14 billion by 2026; a 6.6% CAGR. – MarketWatch

SGC Partners (SGC) estimates that the continued move to outsource Aircraft MRO services will create a significant opportunity for those who can produce results in-line with corporate and shareholder expectations. Based on our observations and experiences with several clients, we believe that realizing this opportunity will require the following:

- Relentless focus on understanding customer requirements and adapting services to lead the industry

- Careful selection of investments that will lead to improved productivity and customer satisfaction and have a clear ROI

- Skillful integration of business functions/departments across the organization. For many, this means effectively integrating the operations of acquired companies

- Strategic execution of initiatives to maximize the effectiveness of the supply chain and, in particular, the assets utilized to provide service

SGC’s Perspective on Aircraft MRO

With the exception of niche sectors and defense, growth in aerospace MRO is expected to be modest, but opportunities exist. Masterful execution will be required to capture both strategic advantage and their associated profits. Net after-tax profits for airlines and, to a lesser extent, Aerospace Original Equipment Manufacturers (OEMs) currently track lower than a composite of all manufacturing companies. Year-to-year margin changes, especially for airlines, are volatile, and the financial success of the airline industry drives new orders or cancellations for commercial aircraft. The aftermarket, driven by strong global airline demand, is pushing year-over-year growth in the high single digits, but pressure from several sources—notably, struggling supply chains requiring extra resources and a lack of used parts due to low retirement rates–is presenting headwinds, a new Canaccord Genuity survey reveals.

Ironically, in this difficult environment, aircraft companies are moving to increase their presence in the MRO space. For many competitors without the required focus and skill, we see this path as a recipe for value destruction. Although the industry has a reputation for generating higher profits and ROE (GE Aviation’s Engine Services, for example, generates margins in excess of 20% from its long-term service contracts with major airlines), the results for others is less clear.

Despite this uncertainty, OEMs, such as Boeing, and independents are “jumping in with both feet” to expand service capacity and capability as airlines look to outsource maintenance to cut and control costs. OEM service divisions are shedding old paradigms to capture a larger share of the market, buying or growing in areas of the supply chain not previously considered core. For instance, some OEMs are buying or growing parts brokerage and component repair operations, and performing overhauls of another OEM’s products. These changes create an opportunity for profitability and, at the same time, significant challenges as companies operate outside previous competencies and further confuse an already very complex supply chain.

The Challenges and the Pay-Off

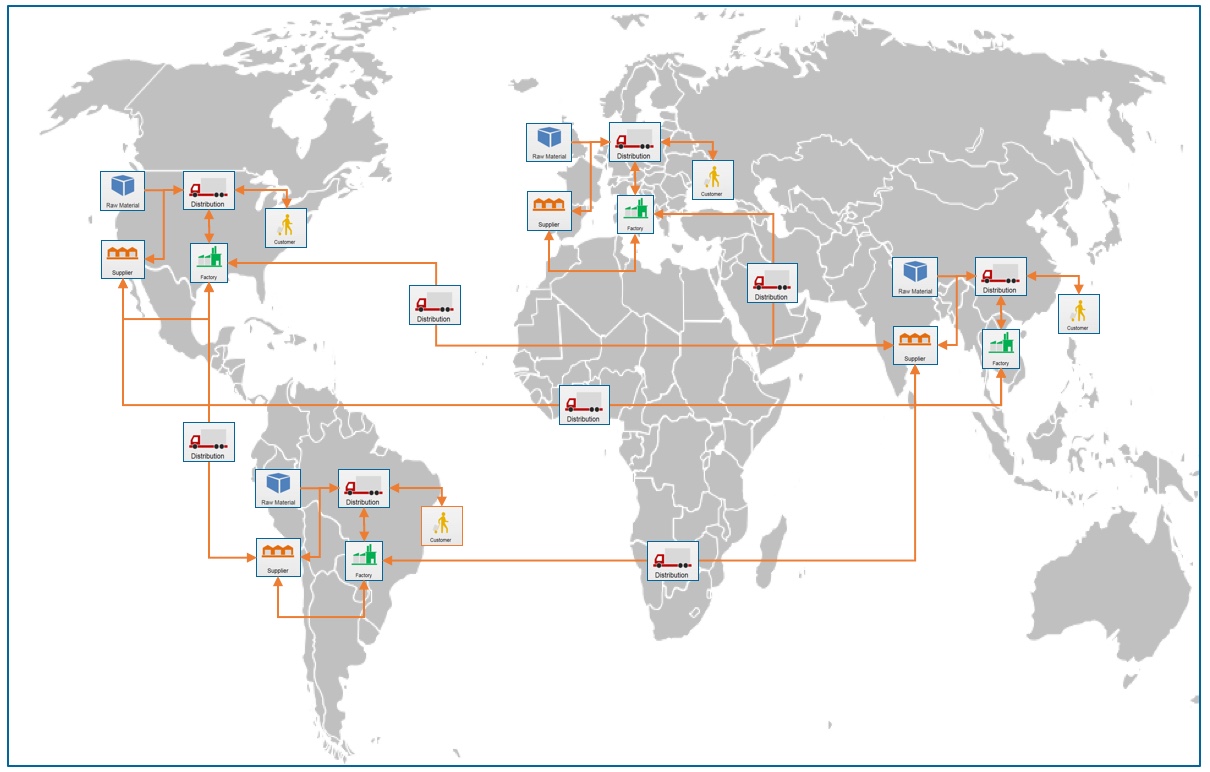

The current state of many Aerospace service operations reflects a complexity that needs to be addressed with new and adaptive solutions. Service organizations are managing complicated supply chains with multiple, competing for distribution channels, a large product portfolio with a high number of SKUs, multiple material flow paths, the need for tightly integrated supplier relationships, and significant reverse logistics issues related to returns for campaigns, or repaired components.

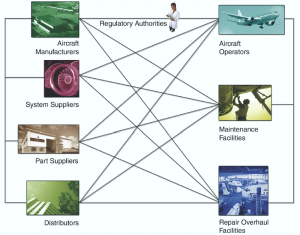

Aircraft MRO Operation Relationships are Complex

Historically, there has been a low corporate investment in MRO operations, as MRO organizations took a back seat to Original Equipment (OE) production. Adding to the difficulty is the fact that organizations are operating with legacy systems that are often 20 years old or more, point solutions are not integrated, and software companies have not sufficiently addressed this market in the past.

Given this landscape, the potential improvement opportunities—and their associated payoffs—are enormous. Based on our experiences thus far, we have typically realized “breakthrough” improvement for our clients as follows:

- Revenue increases of 5-7%

- Return on investment as high as 60%

- Inventory reductions of 30-50%

- Fill-rate lifts from current lows to the 90s

- Revenue increases of 5-7%

- Warehouse productivity gains between 20-30%

- Transportation cost reductions of 8-15%

- Additional benefits reaching 5-10 times the up-front investment

Given the attractiveness of these opportunities, the logical question obviously is: How do we get there from here?

Although we may not have all the answers, we do know where to begin and how to proceed to capture value currently left on the table. The process begins by evaluating your current situation and existing capabilities.

From SGC’s work with MRO companies, we call out a number of pain points and challenges that new or incumbents players need to address or have as yet done so ineffectively:

- High numbers of SKUs with complex interchangeability which make it difficult to forecast effectively, set stock or rotatable levels, plan and process orders with existing planning staff, and utilize customer-owned inventories.

- Low inventory turns with the accompanying need to manage high service level which poses a larger challenge to meeting contract-driven requirements. In addition, the industry is experiencing sporadic, low-volume demand, part number proliferation, complex interchangeability, long lead times, and variable supplier and vendor performance.

- Higher customer service-level expectations that result from customer maturity and extensive experience in their practice of procuring services. Quite simply, customers expect “more, better, faster and cheaper.” And as even more competitors enter the services arena, customers will have more choices. Thus, service providers must excel in operational performance and develop creative contract structures to shape the customer experience and increase loyalty.

- Lack of supply chain visibility which hinders closer cooperation between companies to manage events, improve response time, increase velocity, track serial numbers, smooth demand, reduce inventory redundancy, and increase efficiency.

- Poor warehouse productivity and/or inventory accuracy which causes customer service problems and eroding profitability.

- High obsolescence and excess inventory which drives inaccurate initial provisioning, ECOs without consideration for service inventory, premature or unnecessary part repair, returns, product life-cycle transitions, management decisions to maintain additional platforms, and end-of-life buys.

- Network complexity resulting in an inability to rationalize and/or reconfigure the distribution network to provide better customer service.

- Higher transportation costs which are caused by increased customer delivery expectations, more small shipments, and wider geographic coverage.

To fully capitalize on the value opportunity, organizations need to integrate cleanly across three critical areas: Customer Lifecycle Management, Product Lifecycle Management, and Service Lifecycle Management. In addition, MRO management capabilities must adapt quickly and efficiently to changing market needs in terms of their structure, operations (through sense and respond systems), and better management practices.

Addressing the Business Issues of Aircraft MRO Organizations

In addition, aircraft MRO organizations need contingency plans to deal with a number of current business issues affecting them, including the implications of multiple mergers and acquisitions within the aftermarket services industry, increased competition from the movement of OEMs into aftermarket services to improve their overall margins and stability, decreased demand as the airline industry retires older, maintenance-intensive fleets, and airline labor relations issues.

At the same time, process trends within the Airline MRO industry are towards adopting engineering-driven requirements (such as status monitoring, performance-critical parts), shorter maintenance turn-times, greater time between overhaul, the need to balance in-house versus outsourced maintenance, and FAA/JAA compliance.

The impact of these two trends on MRO inventories is likely to be significant, and will require that management deploy new, special, and increasingly sophisticated inventory tools that are tailored to the high volume of part number/location combinations, complex part interchangeability, need for specific identification, customer usage preference, and operational priority. Effective management will be as much about pinpoint the need for deployed inventory at a specific location, ensuring its availability, while simultaneously minimizing overall logistics, inventory, and system costs. Winning on this new basis of competition has some significant payoffs (about 15-20% of substantial airline structural costs) as follows:

- MRO costs are 10-15% of the total airline operating cost: 10% opportunity

- Airframe parts inventory are approximately 8% of the aircraft price: 20% opportunity

- Engine parts inventory is approximately15% of the engine price: 15% opportunity

These challenges drive the need for proactive and predictive optimization solutions that reduce time to value while increasing top-line growth and bottom-line performance.

Airline MRO organizations must re-tool their operations now to capture these savings by satisfying key needs in the following areas:

- Heavy Maintenance: Optimizing inspection and work activities, planned and unplanned removals, outsourcing, SB, AD and ECO economics, and leasing that includes return condition requirements and maintenance reserves. See a time-lapse video of a commercial aircraft maintenance check https://www.youtube.com/watch?v=GJy-DX-1c04

- Line Maintenance Integrating tightly with flight operations (schedule disruptions) and route planning to ensure timely and efficient results. It also includes dispatch reliability regarding delays and cancellations, preventive line maintenance, insurance spares, and deferrals, spares pooling, visibility of expendables to prevent “parts chasing planes.” See a time-lapse day in the life video of a commercial aircraft line maintenance https://www.youtube.com/watch?v=NgNBtQVG9Xs

- Engine MRO: Optimizing key process elements such as, parts costs that are greater than labor costs, managing engine shop inventory pool, module management through shops, condition and status monitoring/diagnostic tools, power-by-the-hour contracts, and outsourcing (OEM-dominated service companies and JVs). See a time-lapse video of a commercial aircraft engine change https://www.youtube.com/watch?v=aOmCTehtFpI

- Component Repair: Ensuring superior inventory logistics (serviceable vs. non-serviceable or in-house vs. outside repair), managing problem parts, reliability management, outsourcing and supplier management, quality and inspection, and warranty management. ). See a time-lapse video of a commercial aircraft engine combustor repair https://www.youtube.com/watch?v=51kkwNi9opQ

- Other Common Issues: Managing related and “adjacent” areas effectively, e.g. safety/regulatory, inventory, workforce, facility management, and in general connecting the customer contracts to the supplier contracts.

C Checks

SGC’s Solutions for Aircraft MRO Organizations

SGC provides a portfolio of solutions to help manufacturers improve the sales growth and profitability of their aftermarket service and parts operations. Our comprehensive portfolio of services includes three core approach especially suited to this segment, including: Value Accelerators, Supply Chain solutions, and Customer-Focused solutions.

Value Accelerator: Strategic Roadmap

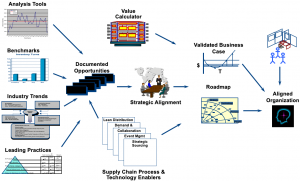

Building an adaptive supply chain requires a holistic, strategy-led approach to change. Moreover, the aerospace MRO supply chain requires a thorough understanding of the complexity aerospace companies deals with. SGC’s MRO Strategic Roadmap provides the analysis and design methodology to help clients move from confusion to action. Based on our experience in this segment, we find that most industry players have begun this process, but it remains either incomplete or suffers from some significant gaps.

In creating an MRO Strategic Roadmap, SGC performs a rapid analysis of how your company’s processes compared with leading practices employed by other aerospace companies and by the MRO industry in general. Working in conjunction with your personnel, SGC completes an extensive analysis and design process. During this phase, we work with you to evaluate and prioritize a portfolio of initiatives to build the MRO Strategic Roadmap, including a high-level implementation plan and a quantifiable business case that will guide your company through the transformation process.

This phase includes the use of a range of tools that include people, process, metrics, and technology enablers to tackle the complexity of building an integrated plan to align your organization for action.

Our recommendations are grounded in your company’s greatest improvement needs and potential market opportunities.

The solution results in:

- A portfolio of suggested strategic and tactical improvement initiatives

- Quantifiable value propositions supporting the business case

- An integrated, high-level implementation plan including risk and change management measures

Strategic Roadmap Process

Focused Solutions

Forecasting & Inventory Deployment: In general, with every 2% of forecast accuracy achieved, there is a corresponding 1% decrease in inventory.

As a starting point, we would ask:

How good is your current forecasting process, what level of error does it generated, and what are the associated penalty costs that your organization incurs?

SGC’s solution enables your company to better understand its demand drivers in order to forecast your customer’s requirements more accurately by integrating disparate planning processes and addressing data challenges that inhibit a robust planning system. The solution is designed to help clients improve planning to achieve:

- The right stock at the right location

- A fully collaborative environment that includes internal entities, suppliers, repair vendors, and customers

- Improved responsiveness to customers

- Proactive management of assets.

The SGC solution uses a holistic approach, including people, process, metrics, and technology. We align organizations to best fit the new collaborative environment, make process changes adaptive to the everchanging business climate, and define metrics for informed decision making that do not compete. And, implement technologies that continue to make substantial strides with a significant focus on reducing the elements that drive variability: Mean Time Between Failure (MTBF), Flight Operations Data, Planned and Unplanned Maintenance, Asset Configurations, Routes and Locations, Marketing Intelligence, Configuration Management and resulting part interchangeability.

Reverse Logistics & Fulfillment: SGC’s technology solutions enable clients to improve repair part supply and return performance, so you gain the ability to manage proactively the end-to-end supply chain during the service part fulfillment and return/ repair/ remanufacturing life cycle. This solution allowing you to:

- Eliminate (or reduce) the need for your own internal DCs.

- Focus instead on monitoring and policing

- Shift responsibility to suppliers

- Reduce disposition time

- Eliminate the part backlog

- Track serial numbers, connecting the serial number of the replaced part with the new part serial number

- Manage campaigns driven by SBs or other programs

Supplier Management & Connectivity:

SGC’s other technology and process solutions enable connectivity to suppliers, logistics providers, customers, and internal legacy systems. This allows all parties to share supply chain event transactions and perform proactive event-based detection and resolution of critical operational issues through web-based connectivity and closed-loop control. The solution provides:

- Visibility: Distributed, web-based access to critical value-chain events, statuses, levels, and capacities

- Performance Reporting: Leverages a centralized data repository to provide enhanced supply chain, vendor and internal performance measurements of the entire supply chain performance This reduces “multiple versions of the truth,” reliance on supplier and vendor performance data and reduces disagreement

- Issue Management: Provides collaborative communications and progress monitoring for companies, suppliers, and repair vendors to effect cause and corrective action for delivery or quality

- Contract Enhancements: To enforce policies written into contracts and often not exercised

- Web User Interface: To facilitate electronic message compliance with suppliers, repair vendors, and carriers

- Event Management & Alerting: Allowing for exception-based management of orders, shipments, levels, or events that will most impact supply chain performance

Field Service Automation/Mobility: Remote connectivity has the potential to dramatically impact service effectiveness. For example, this technology is deployed in the area of line maintenance where tasks may be dispatched along with the tech publication and parts needed. In addition, service manuals, AD Notes, etc. are on tablets, and 2-way IP cameras allow more seasoned technicians to assist more junior technicians on repairs. Depending on your current solution, there may be opportunities to implement “quick hit” improvements in high return areas. Typically, we expect projects of this kind to provide demonstrable ROI within 3-6 months.

Next Steps:

SGC Partners has a proven track record in capturing value in a complex, distributed, and rapidly changing MRO environments, and we would value the opportunity to talk with you regarding our ability to help you achieve your objectives. We have deep Aircraft MRO industry knowledge gained from years of experience and many successful projects. We have an experienced team of professionals with aircraft MRO expertise to help you achieve your goals using powerful methodologies and best-in-class alliance partners.