Automotive Aftermarket – Disruption and Opportunity – Part Two

Automotive Aftermarket – Disruption and Opportunity – Part Two

In this Three-Part series we discuss the Automotive Aftermarket:

- The Industry – Part One

- The Challenges and Strategies – Part Two

- The Opportunities – Part Three

As you remember from reading “The Industry – Part One” (Link), we discussed the three overarching industry trends:

- Changes in customer empowerment and expectations

- Next-generation vehicles

- Shifts in competitive power

Now, we investigate “The Challenges and Strategies – Part Two” that must be overcome to differentiate oneself in the market.

Part Two – The Challenges and Strategies

To succeed in today’s marketplace, leading companies recognize that aftermarket service can help differentiate them from competitors while providing highly profitable revenue. Recent surveys have demonstrated that approximately 50% of the profits made in the auto industry come from service and parts. Although the focus of the past was the way cars are marketed and sold, now we must place a greater emphasis on the aftersales elements of service and parts. These elements can have a disproportionately large impact on the overall customer experience and the profitability of an organization.

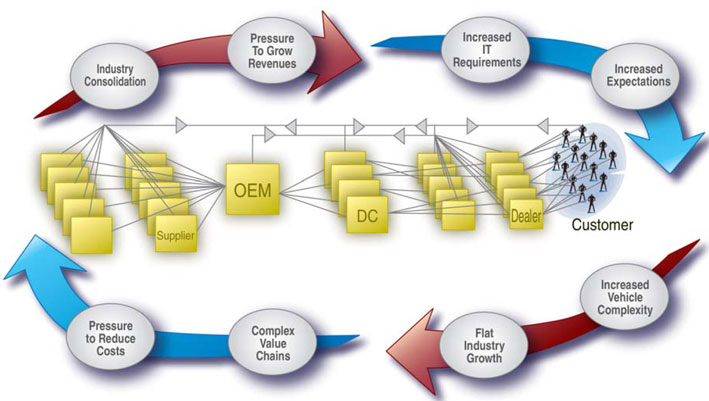

Value Chains Are Increasingly Complex

This complexity leads to multiple material flow paths and parts stocking locations. In addition to various channels, faster introduction of new models leads to accelerated proliferation of stocked components. There are also substantial reverse logistics issues relating to returns and remanufacturing of components. It is increasingly essential for companies to leverage their inventory investment across their network of constituents to meet increasing customer service levels.

Common Pain Points

From our work with automotive aftermarket organizations, SGC has identified some key “pain points” that are representative across the entire value chain:

- High Numbers of Stock Keeping Units Across Multi-echelons (SKUs) make it challenging to forecast effectively, set stock levels, and plan/process orders with existing tools and staff

- Low inventory turns are prevalent as a result of the need to manage high service level requirements, sporadic or low volume demand, part number proliferation, long lead times, and sometimes unreliable supplier performance

- Lack of supply chain visibility may result in redundant inventory, redundant labor, and premium freight

- Poor warehouse productivity and inventory accuracy causes customer service problems and eroding profitability

- High obsolescence caused by inaccurate initial provisioning, part transitions, returns, product life-cycle transitions, and end-of-life buys

- Increasing channel competition is pervasive in the marketplace, especially considering actors with digital genes such as Amazon and others

- Increased network complexity is a result of the need to rationalize and reconfigure the distribution network to provide better customer service

- Higher transportation costs are the outcome of increasing customer delivery expectations, more small shipments, and broader geographic coverage

- Lost revenue and profit potential are the results of antiquated cost-based pricing methodologies

Increased Investment in Information Technology — Source of Competitive Advantage

Historically, automotive aftermarket companies have under-invested in information technology for their aftermarket operations. Existing legacy systems lack integration and experience limited collaboration with trading partners. Given the complexities inherent in today’s supply chain, it is increasingly vital for companies to leverage advanced supply chain technology and big data to provide integrated order fulfillment and more sophisticated planning and forecasting tools and processes.

As customer service levels increase, automotive aftermarket companies require increased visibility of inventory, order, and container status throughout the entire value chain. It will also become increasingly important to collaborate with one’s trading partners. Successful companies must invest in technology tools that will enable them to optimize their entire investment in inventory across the multiple echelons throughout their extended supply chain.

Increased Competition from Dynamic Channels

The smaller independent repairer/installers will continue to vanish as the required investment in technology tools, and training requirements are beyond their reach. Warehouse distributors will continue to consolidate, resulting in larger, more sophisticated, integrated service providers with buying power. Large distributors are investing in supply chain technology and additional assets to provide better service to their customers. OEMs are starting to pursue “Out of Warranty” market opportunities more aggressively, and Dealers, are more willing to perform a broader range of service repairs, leverage promotional tools.

Automotive Aftermarket Service and Parts Issues and Strategies Vary by Vantage Point

These trends will impact all market participants. However, depending upon your organization’s role in the value chain, there are specific trends that are more likely to influence your organization. Automotive service and parts companies should pursue customized strategies and solutions aimed at addressing their specific issues.

Original Equipment Manufacturers

OEMs are experiencing declining profit margins from new car sales and as a result, are increasingly dependent on the aftermarket as a source of corporate profit. OEMs must effectively support dealer networks to grow aftermarket revenue and profit. OEM-specific trends include extended warranties, aggressive pursuit of the “out of warranty” market, alternate parts and accessories sales, increasing technology investments, increased supplier and dealer integration, more vendor direct-ship and shorter vendor lead times.

As OEMs aggressively pursue revenue and profit growth opportunities, they will need to increase the efficiency and responsiveness of their supply/demand chains. Domestic OEMs will continue to rationalize their redistribution centers and importers will continue to add them. Bypass strategies (specifically Vendor Ship Direct) could become a significant opportunity for cost reduction and supplier lead time reduction.

The competition is intensifying between the OEM and aftermarket supply chains. The chain providing the best service to the end customer (at a competitive price) will ultimately gain market share. OEMs are the center of the OE supply chain and have the most control over its progress. Integration between supply chain partners is essential for success.

Finally, for OEMs, more revenue and profit can be obtained from a range of strategies which include focusing on dealers making it easier to conduct business, leveraging business intelligence tools to more effectively mine data to trigger service and sales opportunities, and employment of intelligent pricing.

Dealers have an opportunity to exploit this changing market, but they need to meet increased customer expectations through a more evolved customer focus and tighter integration with OEMs. Dealers are responding to the new market challenges by growing their “out of warranty” service, increasing dealer-to-dealer parts referrals, gaining tighter OEM integration, and using strategies to leverage diagnostics, training, and access to data.

Larger dealers with space for inventory and the ability to make appropriate investments in technology have an opportunity to increase revenues by serving the independent installers.

Traditionally, dealers have dominated the parts market for collision body shops, where long lead times are acceptable. However, in serving independent repair shops, response time is critical to installers as repair bay utilization and turnover is key to their business. This response time requirement requires new investment by dealers in additional last mile delivery assets (trucks), improved customer responsiveness, and better management of inventory.

Suppliers feel these trends through continued price and delivery pressure from trade issues, OEMs and large distributors/retailers, higher performance requirements, and strained profitability and cash flow. Suppliers are shipping more parts direct to deal with higher service levels, shorter lead times, and the need for increased flexibility. OEMs are increasingly pursuing inventory visibility and collaboration programs with their supply base to improve the delivery of parts and reduce inventory variability.

The good news for suppliers is that they may serve multiple supply chains. The bad news is that both chains want increased performance at reduced costs.

Warehouse Distributors (W/D) and Retailers are consolidating to provide increased inventory breadth and better service in terms of response times to their customers. W/D and Retailer sophistication are increasing as they invest in advanced supply chain technology to provide integrated customer fulfillment and web-based ordering. W/Ds are beginning to leverage their buying power and as a result, are placing increased pressure on supplier margins. The OEM’s aggressive push poses a serious competitive threat. W/Ds and Retailers are turning to the increasingly sophisticated technology that allows for greater efficiency and reduced response time as a means to compete with the deep-pocketed OEMs.

For OEMS, Warehouse Distributors and Retailers, Dealers, and Suppliers, the sharing of forecasts and master schedules across the extended value chain will be necessary to reduce lead-times, inventories, and increase capacities. The concept of “thinking and acting as one” to manage the ultimate customers’ assets and experience can provide astounding results.

Read On:

In Part Three, we will discuss “The Opportunities”

- Driving Desired Results

- The SGC Approach